Cleveland

Co-op Fund

Non-extractive financing for co-ops

The Cleveland Co-op Fund

The Cleveland Co-op Fund offers non-extractive loans to cooperative projects in the Cleveland area as a peer fund of the national Seed Commons network. Since 2023 we've made loans totaling more than $600,000 to co-ops such as Rust Belt Riders and Suddy Buddy's.

What is Non-Extractive Financing?

Loans made through non-extractive financing have more favorable terms than those of traditional lenders: repayment is due only when the business is profitable, no personal collateral or credit scores are required, and interest is non-compounding. Unlike traditional financing, non-extractive financing is designed to never leave the borrower worse off.

This type of financing works because we build supportive relationships with our borrowers and become invested in their success. We provide technical assistance to prepare a loan application together and continue providing it all the way through each loan's full repayment in the following ways:

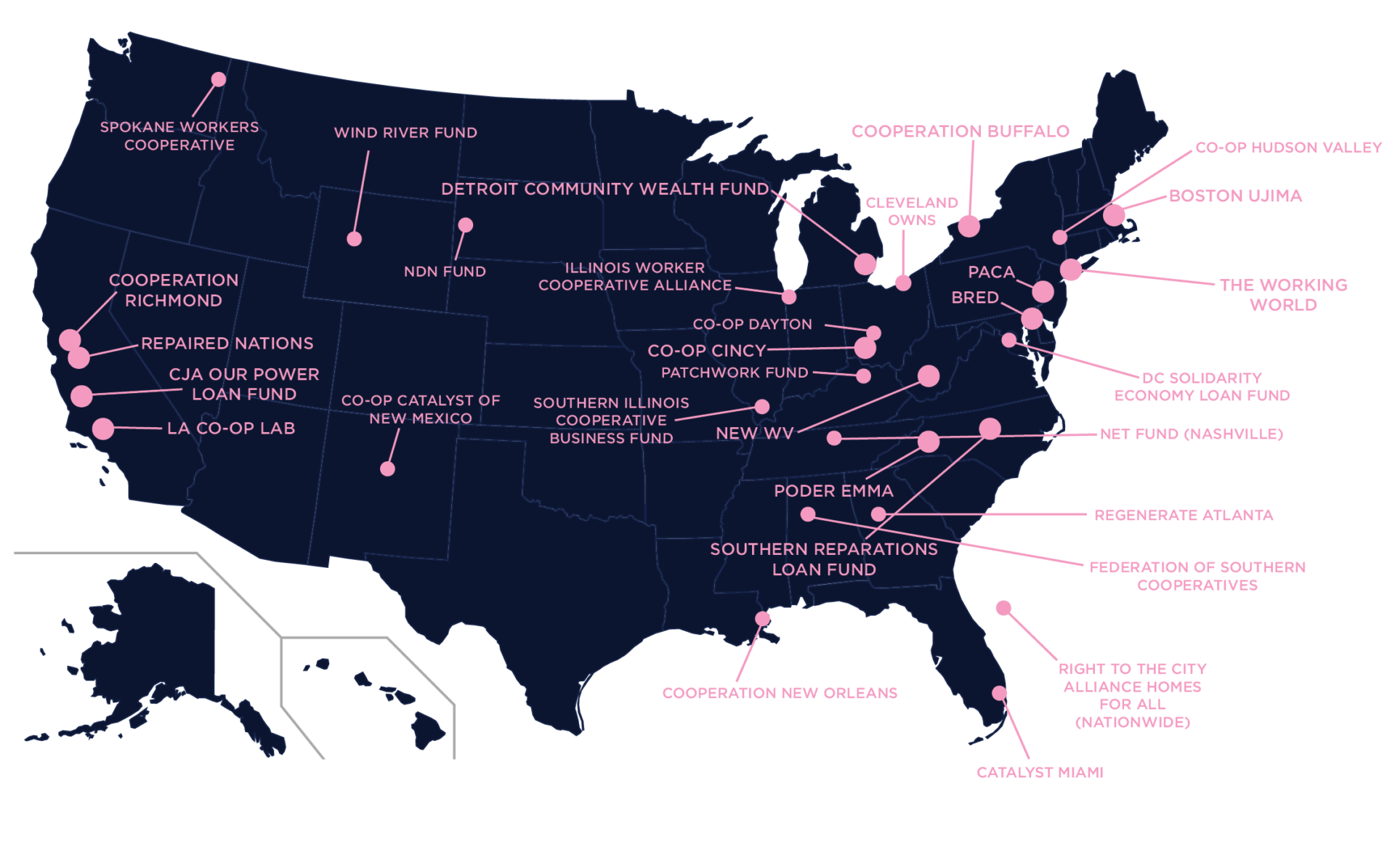

Through our national network of peer funds and co-ops, we make sure borrowers get the resources they need at every step! You can learn more by checking out these resources: Seed Commons Overview and Our Approach to Non-Extractive Finance.

Interested in Non-Extractive Financing?

Are you raising money to fund a new worker or community-owned co-op? Get in touch with us to learn more about the Cleveland Co-op Fund by emailing us at info@clevelandowns.coop

The Cleveland Co-op Fund offers non-extractive loans to cooperative projects in the Cleveland area as a peer fund of the national Seed Commons network. Since 2023 we've made loans totaling more than $600,000 to co-ops such as Rust Belt Riders and Suddy Buddy's.

What is Non-Extractive Financing?

Loans made through non-extractive financing have more favorable terms than those of traditional lenders: repayment is due only when the business is profitable, no personal collateral or credit scores are required, and interest is non-compounding. Unlike traditional financing, non-extractive financing is designed to never leave the borrower worse off.

This type of financing works because we build supportive relationships with our borrowers and become invested in their success. We provide technical assistance to prepare a loan application together and continue providing it all the way through each loan's full repayment in the following ways:

- Business plan coaching

- Setting up finance systems such as open-book accounting

- Navigating governance and cultural questions in running a co-op

- Marketing and light operational support

Through our national network of peer funds and co-ops, we make sure borrowers get the resources they need at every step! You can learn more by checking out these resources: Seed Commons Overview and Our Approach to Non-Extractive Finance.

Interested in Non-Extractive Financing?

Are you raising money to fund a new worker or community-owned co-op? Get in touch with us to learn more about the Cleveland Co-op Fund by emailing us at info@clevelandowns.coop